You are here

- Home

- Comment and Debate

- Background to the Irish Banking Crisis

Background to the Irish Banking Crisis

I have reproduced below a slightly edited version of testimony I gave for the Joint Committee of Inquiry into the Banking Crisis.

I will concentrate on addressing today’s brief which concerns the international, European and Irish policy context of the banking crisis. In doing so, I will be presenting a macroeconomic analysis of the overall crisis which still faces the world’s peoples today at least seven years after its inauguration.

It is important to understand that the situation affecting Ireland at the time of the banking guarantee cannot be characterized only as a financial crisis. Instead, Ireland at this time was caught up in a perfect storm, one whose great winds have periodically abated only to blow up again. It is popular in some quarters to refer to Ireland’s crisis as home grown, and it is certainly true that one storm front blew up within the borders of Ireland. But 2008 saw the tragic convergence of this front with two other influences, one the global storm of the international crisis of global neoliberalism which blew Ireland against the other, the unforgiving shores of the Euro system. We do not have to go all the way back to the proverbial butterfly flapping its wings to find the origins of this maelstrom. The global crisis, the European crisis, and the Irish crisis all find their origins in the same basic institutions of the age. All are rooted in the four institutions of globalization, neoliberalism, repression of labour, and yes, financialization.

What are these institutions?

Globalization is the disintegration of production processes into their component parts and the location of each of these components in that area of the world most congenial to making profits. The production process is then reintegrated through free trade across borders. This process brings employers and workers face to face across the globe.

Neoliberalism is a complex phenomenon. It can perhaps be most succinctly described as market fundamentalism, a belief that important social decisions about production and income distribution are almost always and everywhere best left to be determined in markets. This idea manifests itself in institutions like the World Trade Organization, policies like deregulation and privatisation, and ideologies, like free market economics.

The repression of labour involves the erosion of the power of labour to defend its organizations, its working conditions and its standard of living. It is most dramatically evidenced in the decline in union density.

Financialization according to the American economist Gerry Epstein “refers to the increasing importance of financial markets, financial motives, financial institutions, and financial elites in the operation of the economy and its governing institutions, both at the national and international level.”

All these institutions date from the early 1980s. Their beginnings are marked by the political victories of Ronald Reagan in the United States and Margaret Thatcher in the UK. These new institutions can be collectively labelled the era of global neoliberalism. This new stage of capitalism at first led to recovery. In the 1970s, capitalism was in a period which has come to be known as the Great Stagflation, a condition of simultaneous high unemployment and high inflation, which was unpredicted by the Keynesian economics of the time. Together globalization, financialization, neoliberalism and the loss of labour influence led to a period known in some quarters as the Great Moderation. Profit rates, which had been falling from the late 1960s, bottomed out in the early 1980s, and over time returned to their previous levels. Growth recovered, though it did not reach the standards of the earlier post-World War II period. Employment rose and inflation fell and remained low. But this economic recovery is only one side of the story. The same set of institutions which led to the global neoliberal recovery from stagflation would eventually create the most serious economic crisis since the Great Depression.

Problems became evident almost immediately. Globalization led to the unification of previously separate national markets for goods and services. Competition within this new larger market led to the emergence of excess capacity in many industries. Labour’s loss of bargaining power led to the stagnation of real median family income in the United States. This wage stagnation occurred despite the continual increase in the productive capacity of labour. These two factors, excess capacity and stagnant wages led to a rate of investment which, while positive, was relatively sluggish by historical standards. Remember this relatively sluggish investment was accompanied by restored profitability. If the restored profits were not being invested in productive plant and equipment, where could they go? Financialization made it increasingly easy to fund the purchase of various categories of assets, driving up their prices and creating capital gains, which could only encourage further speculation in asset prices. Borrowing on the basis of rising asset prices temporarily sustained demand in the face of sluggish investment and stagnant wages. But when the asset bubble burst, the full force of listless investment and low wages was felt in the emergence of what was, in Keynesian terms, a crisis of inadequate demand. For the ordinary household, it was a crisis of unemployment.

That’s the global context, but naturally we are much more concerned with the specific situation of Ireland. But a close look at the origins of the CelticTiger reveals that it was a creature of these same four institutions of global neoliberalism: globalization, neoliberalism, the repression of labour, and financialization. As is often the case in Ireland, we had to wait a few years for the advent of global neoliberalism – Irish style. For Ireland the key date is 1987. A neoliberal approach to government in Ireland began when a minority Fianna Fail government came to power in 1987. Minority status led to seeking a consensus economic strategy which could attract the support of other parties. It was supported by Fine Gael’s adoption of the Tallaght strategy under the leadership of Alan Dukes. Two years later the neoliberal Progressive Democrats entered coalition with Fianna Fail. O’Riain and O’Connell (2000 p.329) summarize the turnaround in public spending:

Restoring order to the public finances was achieved by severe cutbacks in public expenditure in 1987-90. Total current spending fell by over 10 percentage points in real terms between 1987 and 1989. Total current spending fell from 57 per cent of GNP in 1985 to 42 per cent in 1990…

The fall in expenditure created room for tax cuts. The top rate of income tax fell from 60% to 48 % over five years (Hardiman 2000b p. 826). Basic corporate income tax rates also fell

In addition to embarking on a new macroeconomic strategy, the new Fianna Fail government also convened the first of a series of tripartite industrial negotiations leading to a national partnership agreement, the Programme for National Recovery (PNR). For the unions’ part, they could sense a rightward shift in the political system and feared that the government might be capable of importing the Thatcherite strategy of a massive attack on the unions aimed at negating their economic, social, and political influence.

The PNR established a basically neoliberal pattern of achieving wage moderation through the promise of future tax cuts. Frank Barry (2004 p.14) calculates that these tax cuts accounted for about one third of the increases in take home pay to 2004. Such moderation under social partnership led to a falling wage share. The wage share was 71 percent of GDP in 1986 and fell to 54 percent in 2001 (Teague and Donaghey 2009 p. 58). Days lost through industrial disputes dropped off drastically beginning in 1987 (Barry 2000 p.1387). Thus the repression of labour in Ireland led not to wage stagnation, as in the United States, but wage moderation under social partnership.

The social partnership process was careful not to jeopardize Ireland’s traditional internationalization strategy. Teague and Donaghey (2000b p. 66) conclude that social partnership operated “hand-in-glove with the wider policy of economic openness.” The Single European Act (SEA) came into effect in 1987 and was approved by referendum in the same year. The implementation of the Single European Market (SEM) coincides with a boom in foreign employment in Ireland with such jobs growing by 50 percent between 1987 and 2000. The SEA was accompanied by plans to expand structural funds spending. Structural funds were doubled in 1988 and again in 1993. A new IDA strategic plan was unveiled in 1983. The new strategy would concentrate on technologically advanced firms with high potential for market growth. These developments copperfastened globalization as an essential element of Ireland’s growth strategy.

The year 1987 also saw the investment hunting capacity of the IDA applied in a new realm. It was decided by the incoming government to target investment in international financial services through the establishment of the International Financial Services Centre (IFSC).

By 1999, attracted by light touch regulation, 66 percent of all FDI inflows were accounted for by the IFSC. It was the source of 24 percent of all services exports. (Grimes 2006 p. 1046) The IFSC would be an important conduit for foreign capital flows and was central to Ireland’s participation in transnational financialization.

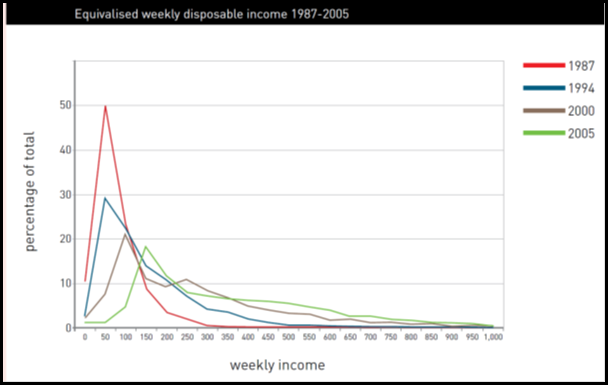

Irish participation in the global neoliberal social order was no longer in doubt and this institutional framework underpinned the advent of the famous Celtic Tiger. Of course, the Tiger is also now infamous because, as was the case at the global level, the elements of global neoliberalism would not only set the conditions for Ireland’s rise but also its spectacular fall from grace. Under Ireland’s peculiar labour institutions, wages rose - but inequality rose much faster.

The fear of Thatcherism had fed into the formation of social partnership. As noted before, wage moderation was traded for tax cuts. This tendency was strongly reinforced by the perceived need to compete globally through low taxes and a neoliberal policy preference for minimizing the capacity of the state.

The economic momentum of the Celtic Tiger eventually fed into blowing up the Irish real estate market. Financialization provided the wind beneath the wings of the Irish asset bubble.

Rising levels of inequality created an aspiration for levels of consumption which, for many, could not be supported from current income. Rising house prices provided an expensive asset of expanding value for those in the housing market and collateral for borrowing by those who already owned their own homes. Household debt rose from less than 120% of disposable income in 2003 to 220% in 2009. The bubble in the property market provided an alternative source of government income through stamp duty and construction-related VAT, compensating to some extent for the overall low tax regime.

Ireland was now poised for crisis. We had a property bubble which could be traced back to financialization. We had high levels of household debt which could be traced to the property bubble and rising inequality. We had a low tax regime which could be traced back to the repression of labour, globalization and neoliberalism. The property bubble burst in 2007, endangering the banking system. The global crisis hit in 2008, intensifying Irish problems. The collapse of banking, construction, and the tax regime produced a fiscal crisis. The financial crisis, the fiscal crisis, and unsustainable household debt then created an unemployment crisis.

It was at this point that the global storm front and the Irish turbulence combined ran up against the sea cliffs of the inflexible Euro system. This Euro system was also rooted in global neoliberalism, a global neoliberalism Euro-style. The drive for globalization led to the single European market. Globalization linked with financialization to create the Euro currency. The single European market and the Euro led to trade surpluses in some countries that were recycled into blowing up asset bubbles and trade deficits in other countries which weakened their fiscal positions. Financialization linked with a strong dose of neoliberal ideology led to a fiercely independent central bank, aggressively limiting its responsibility to inflation control. Neoliberal ideas of small government and limited intervention in private markets, along with the declining influence of labour, led to a monetary union without any fiscal capacity to address problems through increased government spending at European level. Together the single European market, the Euro, the European Central Bank, and limited fiscal capacity can be said to constitute the Euro-system.

When the turbulence hit, the Euro system made sure that Ireland could find no haven through devaluing its currency, conducting an independent monetary policy, or receive help through fiscal stimulus. Indeed the Euro rules have forced Ireland to cut spending and raise taxes in the teeth of a depression. Instead of providing a port in the storm, the backwash from the Eurocliff intensified the maelstrom. On the 29th of September, 2008, in the dead of night, Ireland desperately tried to signal for help, but the canon broke loose and holed the ship of state below the waterline.

How could this catastrophe have been avoided? The only path was to have seen the storm coming and been prepared for it. This is not a question, as some have recommended, of hiring more economists in the Department of Finance. In fact professional politicians and professional economists in the lead up to these events all saw the world in much the same way. To avoid the storm, both would have had to see the world differently. I have lived for twenty years in Galway. It is said of the weather in Galway that it is either raining or about to rain. Similarly, in the mainstream economic view, the economy is either calm or rapidly becoming calmer. This theory may barely pass muster in good times, but to prepare for a storm you have to see the economy as potentially tempestuous and riven with conflict and contradictions. A view of the capitalist economy which ignores its historical dynamics, which sees it as a haven of harmonious give and take, a peaceful equilibrium of supply and demand, which works best when interfered with least, will inevitably lead to foundering on hidden shoals amidst unexpected turbulence. This is where Ireland still finds itself today. Thank you.

Terrence McDonough, March 2015