You are here

- Home

- blog_categories

- Fairness and Financial Markets

- The Government’s New Pension Service Has One Fatal Flaw - Jonquil Lowe

The Government’s New Pension Service Has One Fatal Flaw - Jonquil Lowe

18 February 2015

The UK government has launched its new Pension Wise service. The website is designed to help people understand their new pension freedoms that start from April this year. But it has a gaping hole at its heart: there is no discussion of the risk of outliving your savings.

From April, if you’re aged 55 and older, you have new freedoms to withdraw your pension savings. You will no longer be required to use the bulk of your savings to provide an income once you stop work, but can also opt to take all or part as one or more lump sums at any time.

Making the most of this new financial freedom is a challenge. Drawing off a large lump sum could trigger a hefty tax bill. And taking out too much in lump sums early on reduces the amount left for income.

Equally challenging are the decisions you make once you want to start drawing an income. The main choice is how much of your savings to spend on insurance that guarantees an income for life (an annuity) and how much to leave invested, which allows more flexible access and might generate a higher income. But leaving your savings invested also means taking on the risk that your income could fall or your savings run out partway through retirement.

The risk arises not just because the value of investments can go up and down (investment risk), but because most people have no way of knowing how long they will live, in other words how long their savings will have to last. This uncertainty is called 'longevity risk'.

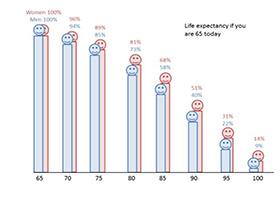

To appreciate longevity risk, consider the chart at the start of this post which shows the probability of a 65-year old surviving to various ages. Predicting where on this chart you lie – and so how long you should make your savings last – is not easy. Annuities provide insurance against this risk by paying an income for life, however long you live, and are likely to be relevant to many people as part of their retirement strategy.

The government has guaranteed that everyone will have access to guidance via the internet, phone or in person, to help them understand the choices they face. The internet guidance offers a step-by-step journey, focused on finding out how much your savings are worth, an outline of each option and the tax implications. But the gaping hole in the guidance is any discussion of longevity risk.

True, in the section plan how long your money needs to last, the guidance quotes Office for National Statistics data that ‘on average, people aged 55 today will live to their mid-to-late 80s. Around one in ten men and one in five women will live to 100’. But in the crucial section on what you can do with your pension pot, there is no mention that some of the options expose you to longevity risk, even though other comparable key features, such as investment risk, tax and charges are highlighted.

This is a vital omission. Alongside current options, new products are expected to come onto the market that will (at a price) mix income guarantees and flexibility. It is simply not possible to weigh up the current options, let alone newer products, without considering the trade-off between secure income and greater longevity risk.

While the UK is moving towards greater pension freedom, several other countries that already have these kind of freedoms (such as Australia, New Zealand and the US are looking at how they can improve the security of retirement incomes. Findings by the Financial System Inquiry in Australia highlight the twin problems that arise from ignoring longevity risk.

The inquiry’s interim report found that 'around one-quarter of people with a superannuation balance at age 55 have depleted their balance by age 70'. Its final report stated:

The major worry among retirees and pre-retirees is exhausting their assets in retirement. An individual with an account-based pension can reduce the risk of outliving their wealth by living more frugally in retirement … This is what the majority of retirees with account-based pensions do, which reduces their standard of living.

The Pension Wise guidance is intended as a first step to alert you to key issues to consider when making pension decisions and lay in a foundation of knowledge that will help you in discussions with any professional financial adviser that you go on to consult. But it misses out longevity risk, which lies at the heart of understanding these decisions. Pension savers cannot afford to ignore this, so neither can Pension Wise.

Jonquil Lowe is a Lecturer in Personal Finance and a personal finance practitioner, who works with a variety of independent, consumer-facing organisations and financial services providers. This article was originally published on The Conversation and we are grateful for their permission to reproduce it.

Share this page:

Contact us

To find out more about our work, or to discuss a potential project, please contact:

International Development Research Office

Faculty of Arts and Social Sciences

The Open University

Walton Hall

Milton Keynes

MK7 6AA

United Kingdom

T: +44 (0)1908 858502

E: international-development-research@open.ac.uk

.jpg)