The banking sector, long seen as a bastion of tradition, is undergoing a transformation driven by digital innovation and a renewed focus on user-centric design. At the heart of this transformation is a shift in thinking that prioritises understanding and meeting users’ real needs. As we explore the role of design in banking, it becomes clear that innovation, when done responsibly and thoughtfully, can lead to significant advancements for both users and organisations.

I recently attended the Banking Transformation Summit at Excel in London, an annual event bringing the banking community together to assess the impact of digital transformation and advance their digital journeys. This year, the summit attracted 2,000 attendees, 250 speakers, and 60 exhibitors over two days, highlighting the ongoing interest in digital innovation within the financial sector.

A standout feature of the summit was the use of silent seminar headphones. Given that the presentation theatres were close to one another, these headphones, provided based on attendees’ chosen talks, mitigated noise and confusion. This feature also made the event more accessible and inclusive, benefiting those with hearing impairments or those standing outside the seating areas.

As expected, a big focus of the talks and the exhibited products and services was on AI. Comfortingly, there was also a lot of talk about the responsible implementation of AI. Innovation is essential for banks to remain competitive but must be done responsibly. Organisations need to be accountable not only to their users but also to their workforce. Transparency about where and why AI is implemented is critical. Banks must ensure that AI undergoes rigorous risk assessment to prevent negative impacts on colleagues and customers. This responsible approach to innovation fosters trust and supports sustainable growth.

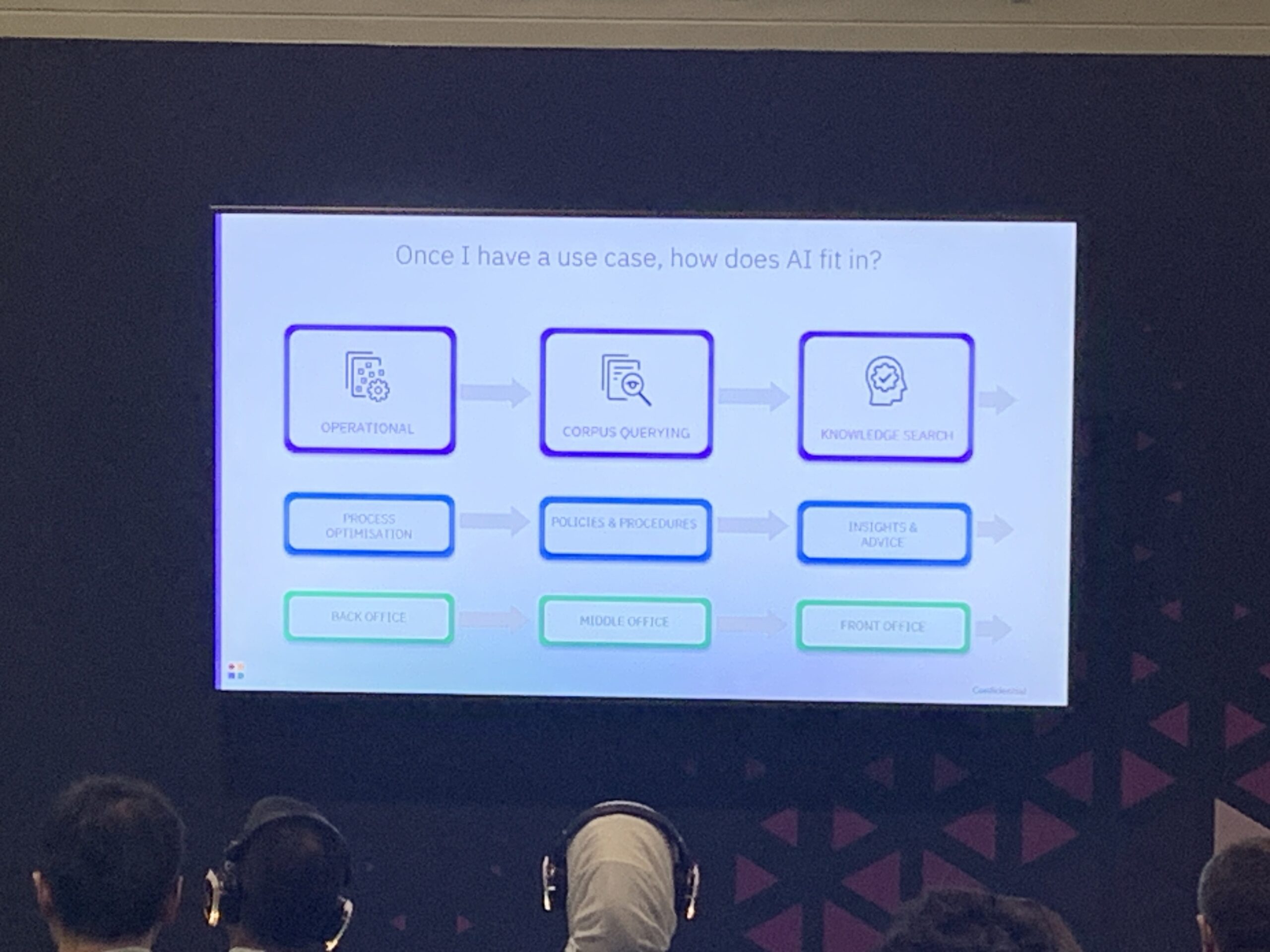

While staying up-to-date with technological advancements is crucial, it does not mean every organisation should integrate AI into every aspect of its operations. First, it is essential to understand the problem at hand and then determine which technology will provide the best solution. During her talk, Aditi Subbarao, Global Financial Services Lead at Instabase, emphasised this point. She highlighted that solving use cases is more important than merely implementing AI, ensuring that technology serves a purpose and adds value.

During the panel discussion that I participated in, we discussed the future of the financial services landscape. My co-panellists, including Andreea Iosub, Head of Data Strategy and Transformation; Matt Livermore, Director of Solutions Engineering, EMEA at Delphix Software; Przemek Gdanski, CEO at BNP Paribas Bank Polska; and our moderator Dieter Halfar, Partner and Head of FS at Elixirr, focused on external factors such as partnerships and ecosystems. I emphasised the importance of internal colleagues and end-users.

As part of the enablement team in NatWest, I prioritise equipping our journey teams to serve our customers effectively. Equipping the workforce with future skills is vital as the banking industry evolves. Life-long learning is key to preparing employees for future challenges. Therefore, banks must invest in continuous learning opportunities to ensure their workforce remains adaptable and capable of driving innovation within the organisation. Financial institutions should also provide their workforce with the necessary tools and frameworks to enable change and foster innovation. However, it is crucial to also focus on mindset. Many companies attempt to implement frameworks like Agile, focusing only on tangible aspects such as cadence meetings and management tools but often fail to embody Agile principles and values like failing fast, simplicity, and trust-building.

I also highlighted the trend of banks hiring unconventional talent. I come from a design strategy background, not banking. My expertise in design theory and implementation brings a fresh perspective. To think outside the box and foster innovation, banks must step outside the box and their traditional hiring practices and broaden their scope. As Einstein once said, you cannot solve a problem with the same mindset that created it.

A key takeaway from the summit was understanding and focusing on user needs. People do not seek a mortgage; they want to buy a house. They do not desire a loan; they want to buy a car to take their children to school. Banks can ensure they do the right thing for their users by looking at use cases. This user-centric approach allows banks to design products and services that genuinely meet the needs of their customers, leading to higher satisfaction and better outcomes.

There were also discussions on user-centric themes such as multi-generational banking, personalisation, customer-centricity, and diversity and inclusion. Multi-generational banking recognises various age groups’ differing needs and preferences, from tech-savvy millennials to traditionalists, ensuring that services cater to a broad spectrum of users. Personalisation involves tailoring financial products and services to individual customers based on their behaviours, preferences, and life stages, enhancing user satisfaction and engagement. Customer-centricity places the user at the heart of all business decisions, ensuring that the customer’s needs and experiences drive the development of products and services. Diversity and inclusion focus on creating an environment that respects and values diverse backgrounds, perspectives, and experiences, leading to more innovative solutions and a more inclusive financial ecosystem. This shift towards a more human-centric approach is promising, as it fosters a deeper understanding of users, improves service delivery, and enhances overall satisfaction and loyalty.

The Banking Transformation Summit offered valuable insights and connections, underscoring the importance of human-centric innovation in financial services. As the industry evolves, embracing diverse perspectives and focusing on user-centric strategies will be key to future success. Banks can design a future that meets users’ needs and supports sustainable growth by focusing on use cases, responsibly implementing AI, and prioritising innovation and continuous learning.

Feature Image by Daniel Gibbon, taken at the Banking Transformation Summit 2024 in London.

Leave a Reply